Yuan outpacing euro Reuters

RT.com

21 Nov 2023, 15:44 GMT+10

Low interest rates have sparked a global rush to borrow in China, the outlet has said

Global companies are reaping record profits through yuan-denominated bonds and are borrowing heavily from Chinese lenders at low interest rates, at a time when the cost of using Western banks is skyrocketing, Reuters reported on Friday.

According to the news agency, international companies and banks are raising record amounts of cash through Chinese 'panda' and 'dim sum' bonds denominated in yuan.

"While the fundamental story is not compelling for Chinese investors looking for growth, the depreciation of the yuan as well as the rate cuts result in a much cheaper cost of borrowing," said Fiona Lim, senior FX strategist at Maybank.

The uptick in China's borrowing market has made the yuan the world's second-biggest trade funding currency, ahead of the euro. The development reflects Beijing's ambitions to boost the yuan's share in global funding, Reuters added.

According to the report, the National Bank of Canada raised 1 billion yuan ($138.6 million) in October from the sale of a three-year panda bond at a coupon of 3.2%, while domestic interest rates stood at 4.5%.

The People's Bank of China (PBOC) has been encouraging banks to lend to international companies and has allowed broader use of the yuan outside the country, the outlet said.

"Panda bonds are steadily promoting the renminbi's function as a funding currency," the PBOC stated in a report last month.

The Chinese yuan showed record gains in September as its share in international payments surged to 5.8%, up from 3.9% at the beginning of the year, outperforming the euro for the first time, data from SWIFT revealed.

The growing share of the yuan in cross-border transactions reflects China's trend of shifting away from the US dollar, as well as Beijing's efforts to promote the use of its national currency.

For more stories on economy & finance visit RT's business section

(RT.com)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Iran Herald news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Iran Herald.

More InformationBusiness

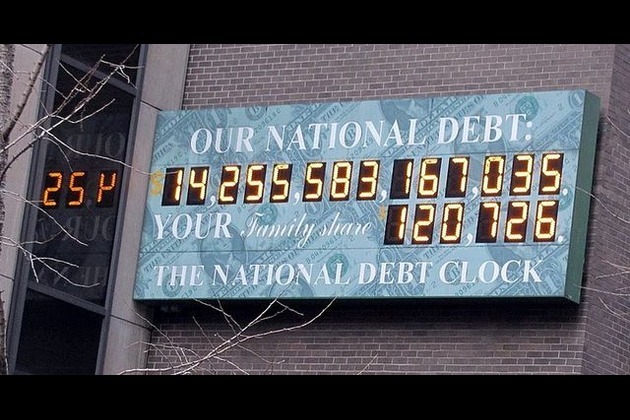

SectionUS debt limit raised, but spending bill fuels fiscal concerns

NEW YORK CITY, New York: With just weeks to spare before a potential government default, U.S. lawmakers passed a sweeping tax and spending...

Shein hit with 40 million euro fine in France over deceptive discounts

PARIS, France: Fast-fashion giant Shein has been fined 40 million euros by France's antitrust authority over deceptive discount practices...

Meta hires SSI CEO Gross as AI race intensifies among tech giants

PALO ALTO/TEL AVIV: The battle for top AI talent has claimed another high-profile casualty—this time at Safe Superintelligence (SSI),...

Engine defect prompts Nissan to recall over 443,000 vehicles

FRANKLIN, Tennessee: Hundreds of thousands of Nissan and Infiniti vehicles are being recalled across the United States due to a potential...

Microsoft trims jobs to manage soaring AI infrastructure costs

REDMOND, Washington: Microsoft is the latest tech giant to announce significant job cuts, as the financial strain of building next-generation...

Stocks worldwide struggle to make ground Friday with Wall Street closed

LONDON UK - U.S. stock markets were closed on Friday for Independence Day. Global Forex Markets Wrap Up Friday with Greeback Comeback...

Middle East

SectionNetanyahu vows 'No Hamas' in postwar Gaza amid peace talks

CAIRO, Egypt: This week, both Hamas and Israel shared their views ahead of expected peace talks about a new U.S.-backed ceasefire plan....

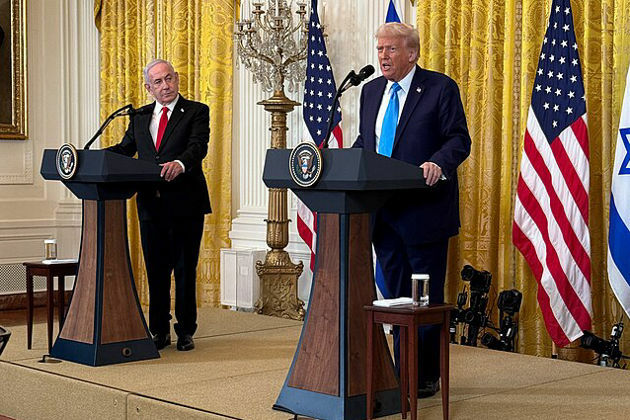

White House meeting between Trump, Netanyahu on July 7

WASHINGTON, D.C.: President Donald Trump will meet Israeli Prime Minister Benjamin Netanyahu at the White House on Monday. President...

Over 60 companies named in UN report on Israel-Gaza conflict

GENEVA, Switzerland: A new United Nations report alleges that dozens of global corporations are profiting from and helping sustain...

UK lawmakers desigate protest group as terrorist organization

LONDON, UK - Lawmakers in the United Kingdom have voted overwhelmingly to proscribe the direct-action group Palestine Action as a terrorist...

Israel launches operation Black Flag against Yemen

The IDF has begun striking Houthi-controlled ports and infrastructure in retaliation for drone and missile attacks Israel has launched...

Israel launches operation 'Black Flag' against Yemen

The IDF has begun striking ports and infrastructure in retaliation for Houthi drone and missile attacks ...